how are qualified annuities taxed

You fund a qualified annuity with pre-tax money money you have yet to pay taxes on. Annuities can be tax-qualified or non-qualified.

The Impact Of The Secure Act On Qualified And Non Qualified Annuities New Jersey Law Journal

Taxes follow some simple rules while the non-qualified variable annuity is accumulating money.

. In general annuities are taxed differently if they are in a qualified or non-qualified account. Non-qualified annuities require tax payments on only the earnings. The earnings on an inherited annuity are.

A non-qualified annuity is an annuity bought with after-tax dollars whereas a qualified annuity is an annuity bought with pretax dollars in most cases. First if your annuity was purchased with IRA or 401k monies then all withdrawals are taxed for the life of the annuity. A non-qualified annuity is funded with money thats already been taxed.

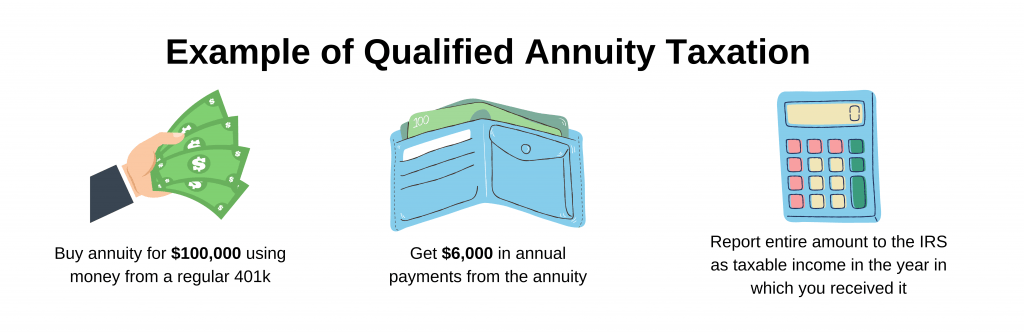

How Qualified Annuities Are Taxed. A qualified annuity is one purchased with pre-tax dollars. Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time.

An annuity you purchase outside of a retirement plan is called a nonqualified annuity while an annuity you purchase within such a plan is a qualified annuity. Nonqualified variable annuities dont entitle you to a tax deduction for your contributions but your investment will grow tax-deferred. When you make withdrawals.

1 day agoIn the slideshow are 11 important tax and financial planning questions and answers advisors should be aware of regarding such investments according to ALMs Tax Facts Online. There are however two main taxation categories. A qualified annuity is a financial product that accepts and grows funds and is funded with pre-tax dollars.

The exclusion ratio is. Qualified annuities are those purchased through a qualified plan like a 401k or SIMPLE IRA and are normally paid for with pre-tax dollars. But you will owe ordinary income tax on the growth.

Owners of qualified annuities are. Understanding which one you have will make a big difference come tax time. The difference between qualified and.

There are no contribution limits and income payments from the. Qualified Annuity Taxation. They can be purchased in retirement accounts or held as free-standing contracts.

It only becomes taxable once you begin receiving the funds from your annuity. Qualified annuities are purchased with pre-taxed income. The amount of taxes on non-qualified annuities is determined by something called the exclusion ratio.

When you inherit an annuity the tax rules are similar to everything described above. Funds for a qualified annuity typically come directly from a 401k a. Generally annuities in qualified or non-qualified accounts are taxed differently.

If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments after death. And when you make a withdrawal the IRS requires. A qualified annuity is distinguished from a non-qualified annuity which is funded by post-tax dollars.

In this case the tax rules governing. That confers certain advantages. Variable annuities - make payments to an annuitant varying in amount.

Qualified annuity distributions are fully taxable. An annuity bought with pre-tax dollars is considered a qualified annuity. Qualified is a descriptor given by the Internal.

No taxes are paid until distributions are taken. Qualified annuities are usually funds from an IRA or a 401 k. You wont owe tax on the amount you paid into the annuity.

All distributions are taxed. This type of annuity is called qualified If however your.

Annuity Taxation How Are Annuities Taxed

/success-1093889_1920-73785c60ea884a3eb06341d5e7422b07.jpg)

How Are Nonqualified Variable Annuities Taxed

What Is The Tax Rate On An Inherited Annuity Smartasset

How Are Annuities Taxed What You Need To Know Smartasset

What Is A Qualified Annuity Due

Annuities Offer Powerful Tax Advantages Plus Some Avoidable Pitfalls

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Vs Mutual Funds Which Is Right For You 2022

Substantial Gains In Your Non Qualified Annuities You Ve Got Options

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Variable Annuities Taxes Match With A Local Agent Trusted Choice

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Annuity Tax Forms For Qualified And Non Qualified Income Annuities

Annuity Taxation How Various Annuities Are Taxed

Annuity Exclusion Ratio What It Is And How It Works